Recapping our Enterprise Quantum Adoption Webinar with EY

Has your organization started down the path to quantum adoption? Curious about where you stand relative to the earliest enterprise adopters? Whether or not you joined our recent webinar with EY, we hope this post can be a helpful recap.

I recently hosted a webinar with Dan Diasio, Global Artificial Intelligence Consulting Leader at EY, to share insights from our First Annual Report on Enterprise Quantum Computing Adoption. You can watch the webinar above, or read on for the key takeaways and answers to the questions we received from the audience.

For background, this past January we published the results of our first annual survey of 300 enterprise leaders (CIOs, CTOs and other VP-level and above decision-makers) at large global enterprises to put our finger on the pulse of enterprise quantum adoption. Executives we spoke to came from 12 industry verticals, each with estimated 2021 revenues exceeding $250 million USD and with estimated computing budgets over $1 million.

We conducted this survey to provide our customers and other quantum-curious enterprises with data to cut through the hype around quantum computing. Armed with this data, enterprise decision-makers can better understand where they stand relative to other large organizations and what they should be doing to better prepare for the quantum future.

Below you’ll find: 1) the key findings from the report that we highlighted in the webinar and/or, if you already read the report, 2) the answers to questions we received from the audience.

As we said in the webinar, we are happy to dive deeper into how EY and Zapata jointly support our customers and how we could accelerate your journey to quantum advantage. Please get in touch with Dan or myself to set up a conversation.

Key Findings from the Report

The earliest adopters are securing their lead — and it will be hard for the rest to catch up.

The most advanced early adopters made up 4.3% of those we surveyed. These organizations are establishing a lead as first-movers — and it will be difficult for “fast followers” to catch up, for a few reasons:

- The tech is maturing exponentially, meaning those that do the hard work now of upgrading their infrastructure to be quantum-ready will be the first to reap the benefits of more advanced hardware in the future.

- Second, the quantum talent pool is scarce and dwindling, and upskilling existing talent will take time.

- Finally, the earliest adopters are locking up valuable IP that will set them up for an advantage over their competitors.

The race for quantum advantage is shaping up a bit like what we’ve seen at IndyCar races through our partnership with Andretti Autosport. Toward the beginning of the race, a small cluster of drivers pull away from the pack and hold their lead throughout the race. While the leaders jockey for first place, most racers end up too far behind to stand a chance.

The earliest adopters expect to gain a competitive advantage in the next two years.

41% of early quantum adopters are expecting some form of competitive advantage within two years, while 12% are expecting a competitive advantage within one year — or they already claim to have one. A competitive advantage is not necessarily a quantum advantage, or the ability of a quantum computer to solve a real-world problem faster than a classical computer. An advantage could also mean acquiring talent or securing patents for proprietary algorithms.

So what are the earliest adopters doing differently to secure their advantage? According to the survey, they are:

- Investing in workforce development. 77% of the most advanced adopters are identifying talent and building their internal team, compared to 52% for other early adopters.

- Moving beyond proof-of-concepts and building pilot applications.

- 28% of early quantum adopters are budgeting $1 million or more for quantum computing — a turning point from the low six-figure R&D budgets of the past.

- Early adopters are twice as likely to be working with outside vendors compared to their peers, underscoring the challenges of adopting quantum computing independently.

Quantum has moved from the fringes to the core of the enterprise analytics agenda.

Quantum computing is now moving beyond mere speculation and has become a priority for enterprise digital transformation. 74% of those we surveyed agreed that “those who fail to adopt quantum computing will fall behind” while 69% have adopted or plan to adopt quantum computing in the next year. 29% have already started adopting quantum in some form.

Machine learning and advanced analytics are the top use cases.

Machine learning (ML) and data analytics problems are the top use cases for early and more advanced adopters of quantum computing — particularly in the US, where 71% of enterprises are investing in ML and data analytics problems compared to 51% worldwide.

This is intuitive: enterprises already have ML talent, algorithms and applications in place. ML is also the quantum use case most likely to deliver near-term business value. Areas where classical ML struggles — such as with generative models for augmenting datasets in predictive models — are better suited for quantum devices.

The complexity of integrating quantum with existing IT is the biggest hurdle to adoption.

49% of respondents said the complexity of integrating quantum computing with their existing IT stack was their greatest hurdle to adoption, more than any other barrier. The earliest adopters have already come to understand this, acknowledging that quantum will augment, rather than “rip and replace”, their existing infrastructure.

Quantum computing is undeniably complex and will only magnify the existing complexity of enterprise IT architectures. The need to manage this complexity calls for new workflows to orchestrate the integration of new quantum components with existing classical resources. Our workflow orchestration platform, Orquestra®, was designed exactly for this purpose.

There will be no one-size-fits all solution; each enterprise will have unique requirements and multi-cloud architectures. This only underscores the need to start early in preparing your infrastructure to accommodate quantum computing.

Early adopters see vendors as necessary, but are concerned about being locked-in

Given the complexity of quantum computing, it’s no surprise that 96% of those we surveyed said they could not adopt quantum computing without the help of a trusted vendor. However, they don’t want to be locked in with the wrong vendor: 73% were at least somewhat concerned about vendor lock-in, while 47% were very or extremely concerned. The more committed they were to being first movers, the more they feared being locked in.

This fear is only natural. We’re still in the early days of quantum computing, and it’s far from clear which vendor will be the right choice. To mitigate the risk of being locked-in with the wrong vendor, enterprises should prioritize the flexibility to integrate future advances in hardware and software into their quantum workflows. Indeed, our survey found that forward compatibility was the top consideration when assessing a quantum vendor.

Questions from the Audience

What are the biggest misconceptions about quantum computing?

The biggest misconception is that quantum computing is going to replace classical computing. It won’t. Quantum computers will solve specific problems that are intractable for classical computers or speed up bottlenecks in existing classical problems. For everything else, there’s no reason to abandon classical computers. In fact, quantum computers will likely always work in tandem with classical computers.

Another misconception is that quantum advantage will arrive on a day that can be circled on the calendar. We believe it will arrive gradually for specific use cases, then rapidly pick up steam as the hardware advances.

Lastly, people tend to assume you need to understand qubits to use quantum computers. However, like with other compute technologies that came before quantum, the hardware will be abstracted to the point where you can code solutions that use quantum computers without understanding the mechanics of the underlying hardware. It will be like how you don’t need to know how a CPU works to code in Python. It’s more important to understand the business value to be gained from quantum than the underlying hardware.

What question are you hearing most from customers today?

The question we hear most often is: “When do we need to start caring about quantum?” If there’s any lesson to be drawn from the report, it’s that the time to start caring was…yesterday. The earliest adopters are already making headway with upgrading their infrastructure, building applications, and developing their workforces; if you don’t want to be left behind, you need to start doing the same — even though a true quantum advantage is still several years away. Ignore the hype in the press about different breakthroughs in hardware and focus on how you can start preparing today.

We also get a lot of questions about security. One of the most significant potential uses of quantum computers is their ability to decrypt RSA and other encryption schemes that secure most of the world’s digital infrastructure. For answers to all your security-related questions, check out our recent FAQ blog post on the subject.

Will quantum applications follow a similar path to AI, in that algorithms will be open source while workflows and analytics environments are commercialized (e.g., Databricks)?

Eventually it may follow the same approach. However, unlike with AI, access to quantum hardware is extremely limited, so there for the foreseeable future there will be commercial value in making the most of that limited and costly hardware time. This means there is value in commercial algorithms that optimize that usage, similar to how we see commercial algorithms for intensive compute problems today, such as the best-in-class optimizers. This would be in addition to commercial platforms that manage and coordinate hardware access. Thus, we may see commercial algorithms in addition to commercialized environments. However, with support of hardware companies and academia, in the long term we believe most algorithm development will occur primarily in the open source model.

Ultimately, however, we’ll likely see a combination of models. At Zapata, for example, we’ve integrated open source libraries and the libraries of our partner organizations on our Orquestra platform, but we are also building Zapata’s own proprietary methods and algorithms into the platform for our customers to take advantage of.

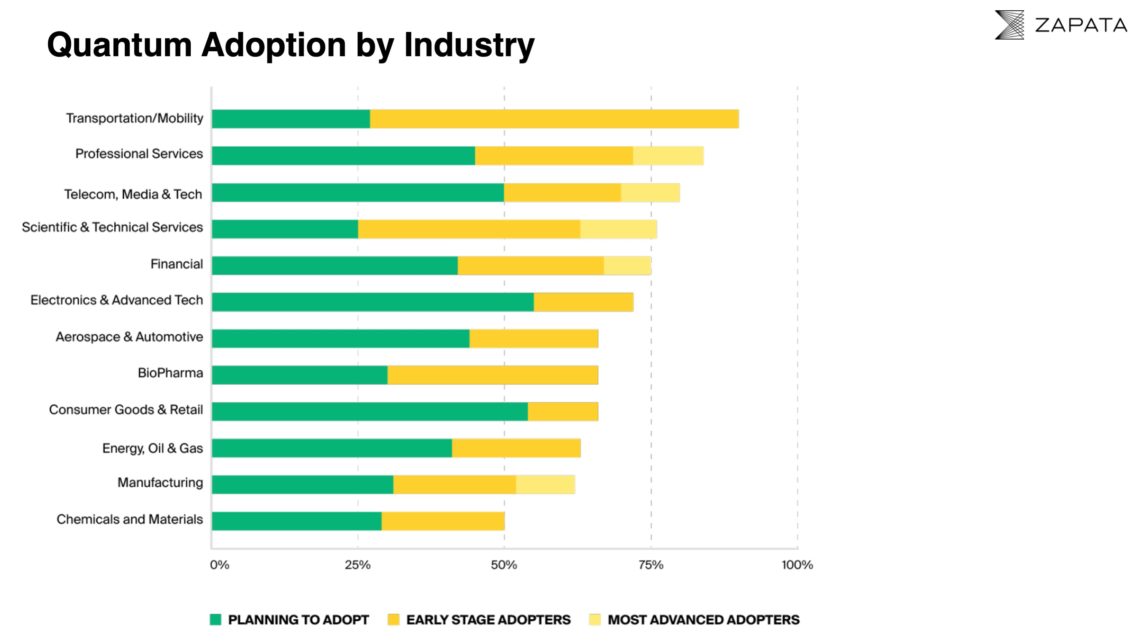

Which industries are the furthest along in quantum adoption?

Our survey showed the Transportation/Mobility industry is the current leader in adopting quantum computing, with 63% of survey respondents reporting early-adopter status. This is likely a response to the ongoing supply chain crisis: quantum computing has the potential to optimize logistics networks to dramatically increase efficiency and reduce costs. We also suspect that transportation/logistics as a business function (vs. the core business) is a major driver for adoption across industries, as we are seeing customers in various verticals approach these problems with quantum methods.

Trailing behind the transportation sector are the Scientific and Technical Services and BioPharma industries, with 38% and 36% early adoption rates, respectively. Meanwhile, Professional Services has the most advanced adopters, at 24%. This may be because their job is to answer questions from other companies on what they need to do to adopt quantum. For example, our partner EY helps clients build quantum into their digital transformation efforts and analytics agendas.

Considering there’s no quantum advantage with NISQ (Noisy Intermediate Scale Quantum) hardware, what business value is there to be gained?

For now, there are specialized jobs where quantum computers have demonstrated a boost to classical methods, especially in training machine learning models. But quantum devices cannot yet support deployed solutions, and we haven’t yet seen a quantum advantage over classical methods from today’s NISQ devices. That said, those that wait to upgrade their infrastructure or assemble their quantum teams won’t be able to use the more mature quantum devices when they’re available.

We can also deploy solutions today that use quantum methods on classical hardware. When we talk about building quantum-ready applications® at Zapata, we are focused on building mostly classical or entirely classical, quantum-inspired applications that can go to production in the near term. Customers can do the hard work of taking an app to deployment now, and when more performant quantum hardware is ready, our customers can swap it in on the back end with just a few lines of code to gain a quantum boost. This approach to deploying applications means we can deliver meaningful business value for customers today—and potentially exponential business value tomorrow with real quantum hardware.

What are the practical applications of quantum computing in drug discovery in the NISQ era?

One of the most promising quantum applications for the drug discovery process is using VQE (Variational Quantum Eigensolver) to simulate molecules and their interactions with cellular receptors. Zapata’s co-founders first developed VQE in 2014 and we have done applied customer work in this area. However, even with proprietary methods like Robust Amplitude Estimation or classical boosting, we’ll need much more powerful quantum computers than we have today, so it’s too far off to be considered a near-term application.

There is, however, a cluster of near-term opportunities in biopharma (think next 2-6 years) that can leverage quantum generative modeling and optimization to generate near-term value across the pharma value chain. This includes ETL optimization, clinical trial data analysis and patient selection, supply chain and manufacturing optimization, advertising optimization, and using GANs (Generative Adversarial Networks) to generate novel molecules.

Have any lingering questions?

Get in touch to schedule a briefing.

About Our Partnership with EY

Zapata has partnered with EY to deliver world-class consulting and solutions in quantum, bridging the gap between classical and quantum solutions for our customers. Zapata provides customers with the platform, infrastructure and applications to leverage quantum, while giving customers access to our scientists and engineers who can help deploy those solutions. Zapata helps customers build Quantum-Ready Applications®, starting with discovering use cases, modeling ROI, piloting, and if they perform well, moving them to production.

Meanwhile, EY is focused on helping clients develop their quantum adoption strategy and roadmap. This includes demystifying quantum, securing funding from executive leaders, managing risk across different hardware innovations, and helping organizations accelerate their path to quantum readiness. This usually involves a talent assessment and guidance on building out partnerships and relationships with academic institutions or national labs.